-

- Contact Us

MN103S65GHF Test Results & Sourcing Insights for Buyers

Procurement teams prioritize components that show consistent performance across lab and field use; aggregated lab and field reports plus buyer-return data highlight why MN103S65GHF is on many watchlists. This guide synthesizes test results, explains how to judge them, and gives practical sourcing steps to reduce supply and quality risk for purchasing teams.

1 — Background: What MN103S65GHF Is and Why Buyers Care

Key specifications to surface

Point: Buyers must know core electrical ratings, package type, and common variants to assess suitability. Evidence: Aggregated lab summaries typically report voltage/current ratings, thermal limits, and package codes as the first-line specs. Explanation: Those specs—especially max junction temperature and package thermal resistance—most strongly affect reliability and should drive procurement acceptance criteria.

Typical applications and buyer requirements

Point: Understanding end-use clarifies QA rigor required. Evidence: Field reports and buyer return trends show different failure tolerance for consumer versus industrial deployments. Explanation: Applications with continuous duty or exposure to wide temperatures require stricter incoming sampling, extended burn-in, and regulatory documentation (e.g., RoHS declarations, flammability ratings).

2 — Consolidated Test Results: What Lab and Field Data Show

Lab-test summary: what metrics matter

Point: Core metrics to collect are electrical performance over temperature, thermal behavior, burn-in outcomes, and accelerated life results—these form the backbone of test results reporting. Evidence: Consolidated lab reports often include parameter drift, leakage vs. temp, and time-to-failure under stress. Explanation: Present results with tables of mean±SD and clear pass/fail thresholds to expose anomalies and variability.

Field performance and failure modes

Point: Field data can reveal failure modes absent in lab settings. Evidence: Aggregated field reports commonly cite early-life failures, thermal degradation, and intermittent electrical opens. Explanation: When lab and field diverge, weight field evidence higher for deployed environments but use controlled lab replication to isolate root causes before supplier action.

3 — How Tests Were Performed & How to Judge Their Reliability

Test methodology checklist

Point: A reproducible methodology is essential to trust results. Evidence: Credible reports list sample size, test conditions, instrumentation, lab accreditation, pass/fail criteria, and raw data availability. Explanation: Ask for those items explicitly; accredited lab results plus full raw datasets score highest on a simple rubric for report credibility.

Interpreting statistics and spotting red flags

Point: Buyers must read distributions not single numbers. Evidence: Red flags include tiny sample sizes, undisclosed conditions, repeated identical numbers, or unsupported MTBF claims. Explanation: Request confidence intervals, survival curves, and clear censoring notes; small N and opaque conditions sharply reduce confidence in reported reliability.

4 — Sourcing Landscape & Risk Mitigation Strategies

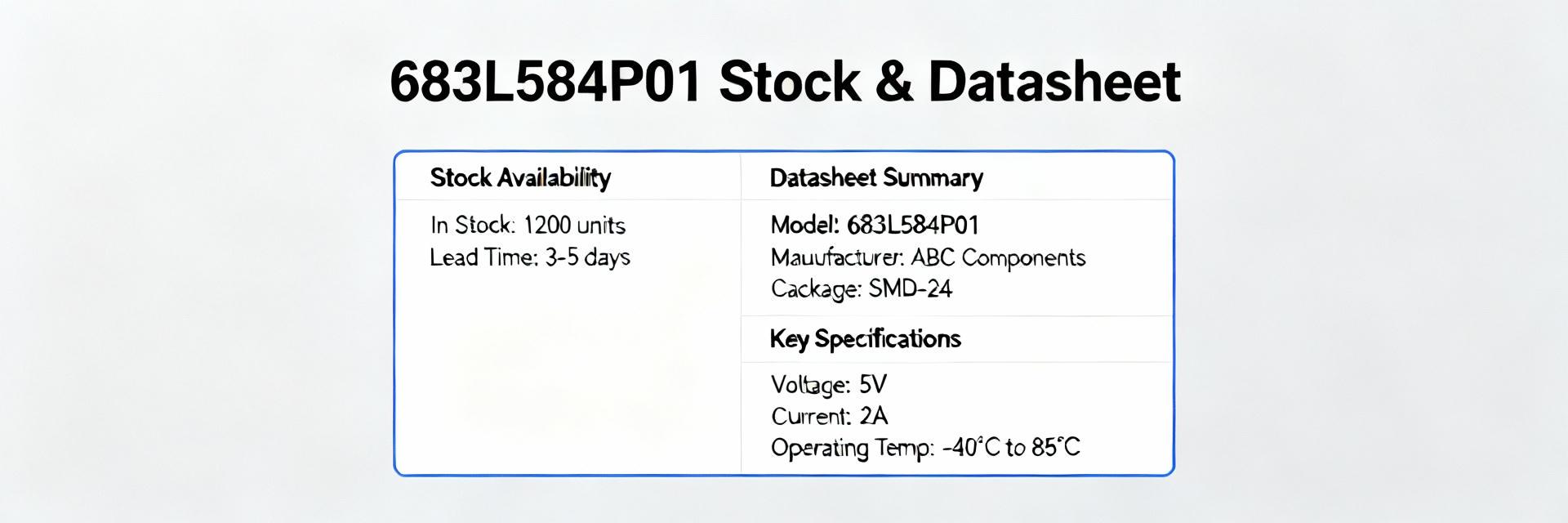

Authorized vs gray-market supply: verification steps

Point: Verification prevents counterfeit or remarked parts entering production. Evidence: Practical checks include datasheet cross-check, lot and packaging traceability, COAs, and independent sample testing as part of sourcing. Explanation: For sourcing, require packaging photos, lot traceability, and a written declaration of origin; escalate to sample testing before PO for unknown suppliers.

Supplier risk factors and how to mitigate them

Point: Common risks include counterfeits, binning/remarking, and lot inconsistency. Evidence: Buyer-return trends often spike after large, single-lot purchases or when prices suddenly drop. Explanation: Mitigate with staggered orders, sample burn-in, escrow testing, and a documented on-arrival QC plan tied to payment milestones.

5 — Cost, Lead Time & Quality Trade-offs for MN103S65GHF

Pricing and lead-time signals buyers should monitor

Point: Price and lead-time shifts are actionable risk indicators. Evidence: Sudden price drops, unusually long lead times, or new suppliers often precede quality issues in aggregated market reports. Explanation: Monitor MSRP spreads, require firm lead-time commitments in contracts, and use planning buffers or safety stock when signals diverge from baseline.

QA measures that affect landed cost

Point: Extra QA increases landed cost but reduces failure risk. Evidence: Typical added steps—incoming inspection, third-party testing, extended burn-in—each add time and unit cost. Explanation: Use a simple estimate: added QA cost = (inspection cost + test cost + time-cost) per unit; compare to expected failure cost to decide threshold for extra testing.

6 — Buyer Checklist & Actionable Next Steps

Pre-purchase checklist (what to request and test)

Point: A concise pre-purchase checklist standardizes requests. Evidence: Required items: datasheets, full test reports with raw data, lot traceability, sample 100% inspection photos, and contractual acceptance criteria. Explanation: Sample language to request: “Provide full raw test data, lab accreditation, and lot traceability documents for the proposed shipment; hold shipment pending sample verification.”

Post-arrival QA & contingency planning

Point: On-arrival QC prevents bad lots entering production. Evidence: A recommended protocol: random sampling plan, functional test batch, 48–96h burn-in, and documented acceptance thresholds. Explanation: If lots fail, place lot on hold, notify supplier with evidence packet, initiate replacement or credit per contract, and log findings for future supplier decisions.

Summary

- MN103S65GHF testing must be judged by methodology and field correlation: insist on accredited labs, raw data, and representative field data to validate lab conclusions and reduce procurement surprises.

- Verify supply chain provenance before buying: datasheet cross-checks, lot traceability, packaging photos, and independent sample testing are practical proof points to demand from suppliers.

- Operationalize on-arrival QA and costed mitigation: use a sampling plan with burn-in, calculate added QA cost versus expected failure impact, and include contingency clauses in POs to protect production.

FAQ

What should buyers request to validate MN103S65GHF test results?

Request an accredited lab report with sample size, environmental conditions, instrumentation details, raw datasets, and defined pass/fail criteria. Evidence-backed reports should include statistical summaries and survival analysis; without these elements, treat results as low confidence and require independent verification.

How does sourcing impact risks for MN103S65GHF?

Sourcing from unauthorized channels increases counterfeit and remarking risk. Ask for traceability, COAs, and packaging verification; if suppliers cannot provide these, require on-arrival sample testing and limit order sizes while an audit is arranged to reduce exposure.

What immediate steps reduce procurement risk if a lot fails arrival QA?

Hold the remainder of the lot, quarantine failed samples, notify supplier with documented failure evidence, invoke contractual return/replacement terms, and schedule third-party failure analysis. Maintain clear records to support escalation and future supplier selection decisions.

- Technical Features of PMIC DC-DC Switching Regulator TPS54202DDCR

- STM32F030K6T6: A High-Performance Core Component for Embedded Systems

- Tamura L34S1T2D15 Datasheet Breakdown: Key Specs & Limits

- PAL6055.700HLT Datasheet: Complete Technical Report

- FDP027N08B MOSFET Datasheet Deep-Dive: Key Specs & Test Data

- LT1074IT7: Complete Specs & Key Parameters Breakdown

- How to Verify G88MP061028 Datasheet and Specs - Checklist

- NFAQ0860L36T Datasheet: Measured IPM Performance Report

- 90T03P MOSFET: Complete Specs, Pinout & Ratings Digest

- 3386F-1-101LF Datasheet & Specs — Pinout, Ratings, Sources

-

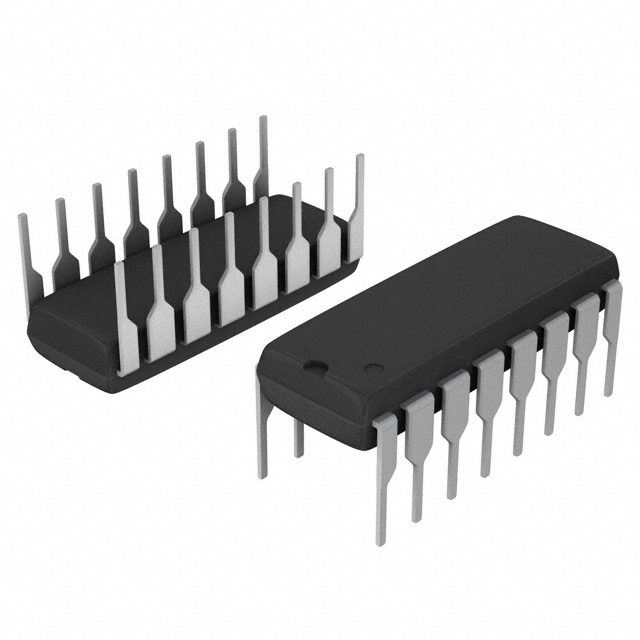

MM74HC4050NSanyo Semiconductor/onsemiIC BUFFER NON-INVERT 6V 16DIP

MM74HC4050NSanyo Semiconductor/onsemiIC BUFFER NON-INVERT 6V 16DIP -

MM74HC4049NSanyo Semiconductor/onsemiIC BUFFER NON-INVERT 6V 16DIP

MM74HC4049NSanyo Semiconductor/onsemiIC BUFFER NON-INVERT 6V 16DIP -

MM74HC4040NSanyo Semiconductor/onsemiIC BINARY COUNTER 12-BIT 16DIP

MM74HC4040NSanyo Semiconductor/onsemiIC BINARY COUNTER 12-BIT 16DIP -

MM74HC4020NSanyo Semiconductor/onsemiIC BINARY COUNTER 14-BIT 16DIP

MM74HC4020NSanyo Semiconductor/onsemiIC BINARY COUNTER 14-BIT 16DIP -

MM74HC393NSanyo Semiconductor/onsemiIC BINARY COUNTR DL 4BIT 14MDIP

MM74HC393NSanyo Semiconductor/onsemiIC BINARY COUNTR DL 4BIT 14MDIP -

MM74HC374NSanyo Semiconductor/onsemiIC FF D-TYPE SNGL 8BIT 20DIP

MM74HC374NSanyo Semiconductor/onsemiIC FF D-TYPE SNGL 8BIT 20DIP -

MM74HC373NSanyo Semiconductor/onsemiIC D-TYPE TRANSP SGL 8:8 20DIP

MM74HC373NSanyo Semiconductor/onsemiIC D-TYPE TRANSP SGL 8:8 20DIP -

LT1213CS8Linear Technology (Analog Devices, Inc.)IC OPAMP GP 2 CIRCUIT 8SO

LT1213CS8Linear Technology (Analog Devices, Inc.)IC OPAMP GP 2 CIRCUIT 8SO -

MM74HC259NSanyo Semiconductor/onsemiIC LATCH ADDRESS 8BIT 16-DIP

MM74HC259NSanyo Semiconductor/onsemiIC LATCH ADDRESS 8BIT 16-DIP -

MM74HC251NSanyo Semiconductor/onsemiIC MULTIPLEXER 1 X 8:1 16DIP

MM74HC251NSanyo Semiconductor/onsemiIC MULTIPLEXER 1 X 8:1 16DIP