-

- Contact Us

S6S1RP SCR Stock & Specs Report: Live Levels, Pricing

The market for the S6S1RP shows pronounced inventory volatility and a widening price spread across authorized distribution and broker channels. Live stock snapshots repeatedly flag small-quantity availability, sporadic reel supply, and premium spot pricing that can inflate procurement cost by double-digit percentages for urgent buys. This report synthesizes live stock signals, pricing behavior, and the critical electrical and mechanical specs engineers and buyers need to validate before committing to orders.

Purpose: give procurement and engineering teams a compact, data-driven playbook to interpret S6S1RP availability, decide when to buy, and verify parts quickly. The analysis focuses on reliable checklist items, sourcing workflows, and the exact specs that determine interchangeability for phase-control and protection designs.

Background What the S6S1RP SCR Is and Why It Matters

Quick product snapshot and use-cases

Point: The S6S1RP is a sensitive‑gate silicon controlled rectifier in a compact DO‑214/Compak SMT outline, optimized for low‑current phase control and protection. Evidence: typical published parameters show a 600 V repetitive peak reverse rating with an average on‑state current in the sub‑ampere range and surge capability for inrush events. Explanation: designers choose this family for board-level AC phase dimming, small motor control, and crowbar protection where small footprint and reliable trigger performance matter.

Key identifiers to spot the S6S1RP

Point: Accurate identification prevents counterfeit or wrong‑rating parts. Evidence: inspect package outline, top‑side marking, and datasheet cross‑references. Explanation: compare the molded type code and lot marking to the datasheet outline, verify package dimensions and pad footprint, and confirm rated Vrrm/It(av)/Itsm on the datasheet versus the part label before acceptance.

Data Analysis Live Stock Levels: How Availability Looks Right Now

Real-time snapshot methodology

Point: A responsible snapshot aggregates multiple signals rather than a single quote. Evidence: combine authorized distributor availability feeds, authorized rep confirmations, vetted broker quotes, and any internal MRP stock. Explanation: update frequency should be daily for urgent SKUs; watch for stale indicators such as TTL "available" flags without lot coding—those often mean backorder or virtual inventory rather than physical reels.

Regional/segment availability patterns & lead-time signals

Point: US availability commonly fragments into small cut‑tape and full reel bands. Evidence: short reels and cut‑tape appear more frequently for emergency buys; full‑reel allocations show longer lead times. Explanation: treat quoted lead times under 4 weeks as tactical short‑order windows; anything beyond 8–12 weeks signals allocation or production constraints and should trigger alternate sourcing or design alternatives.

Data Analysis Pricing Trends & Market Spread

Current price spread and MOQ patterns — what to expect

Point: Unit price can vary substantially by MOQ and channel. Evidence: expect spot buys at small quantities to carry high premiums versus reel pricing and broker markups. Explanation: typical behavior: single‑digit quantity spot prices may be several times reel unit cost; evaluate the break‑even quantity where paying offshore or broker premiums becomes uneconomical compared with lead‑time acceptance.

How to track price movement and signal alerts

Point: Track simple moving metrics to time buys. Evidence: monitor a 30‑ and 90‑day moving average, last‑90‑day high/low, and price bands by quantity. Explanation: set alerts when spot price exceeds the 90‑day average by >25% or when reel quotes drop below a historic threshold; maintain a spreadsheet with quantity bands and an alert column to trigger PO or negotiation.

Specs & Performance Critical Electrical & Mechanical Specs to Highlight

Must‑include specs for engineering validation

| Parameter | Typical Value / Note |

|---|---|

| Vrrm (Repetitive Peak Reverse) | 600 V |

| It(av) (Average On‑State Current) | 0.8 A |

| Itsm (Surge Peak) | 12 A |

| Vgt / Igt (Gate Trigger) | Low‑microamp/gate sensitive (datasheet range) |

| Ih (Holding Current) | Low, verify for low‑current circuits |

| Tj max | ~125 °C (confirm datasheet) |

| Package | DO‑214 / Compak SMT |

Point: These parameters are minimum validation items. Evidence: datasheet fields and actual part markings must match. Explanation: confirm Vrrm, continuous current, surge capability, gate sensitivity, and thermal limits; replacements should meet or exceed these values and be evaluated for thermal derating in the target PCB layout.

Thermal, mounting and reliability notes

Point: Thermal management and mounting affect life and performance. Evidence: package thermal resistance and board copper area control junction rise. Explanation: prioritize thermal derating, correct solder profile for DO‑214 SMT, and include temperature cycling and surge tests in incoming inspection for long‑run buys.

How-to How to Source, Verify, and Secure S6S1RP Stock

Sourcing workflow and prioritization (authorized → vetted brokers → last‑resort)

Point: Follow a strict sourcing precedence. Evidence: authorized channel verification and traceability are primary risk mitigants. Explanation: stepwise workflow—confirm product active/obsolete status, request official datasheet, confirm reel/cut‑tape packaging, request lot and traceability paperwork, and only then accept vetted broker quotes with photographic and paperwork proof.

Authenticity & quality verification checklist

Point: Practical checks reduce counterfeit risk. Evidence: mismatch in markings, weight, or packaging are red flags. Explanation: require high‑resolution photos of markings and package, compare dimensions to datasheet, request sample destructive/XRF or functional test for high‑value buys, and reject parts with blurred markings or missing traceability documents.

Case Study & Alternatives Procurement Scenarios and Compatible Replacements

Short‑run purchase scenario: immediate curbside need

Point: For urgent small quantities, accept controlled premium with rapid verification. Evidence: small buys often cost more per unit. Explanation: checklist for fast turnarounds—request photos, confirm lot code, perform quick continuity/trigger test on sample, use temporary BOM override with planned replacement once production‑grade stock is secured.

High‑volume procurement: cost, lead‑time negotiation & replacements

Point: Negotiate for forecast visibility and staggered deliveries. Evidence: suppliers respond to firm forecasts with better pricing. Explanation: when approving cross‑references, require equal or greater Vrrm and surge rating, compatible package or validated footprint adapter, and documented thermal performance before sign‑off.

Actionable Immediate Buying Checklist & Next Steps for Buyers

Prioritized 10-step buying checklist

- Confirm required electrical specs against datasheet.

- Gather realtime stock quotes across channels.

- Request traceability paperwork and lot codes.

- Compare MOQ bands and unit pricing.

- Request and test samples before bulk PO.

- Perform basic visual and dimensional inspection.

- Confirm packaging (reel vs cut‑tape) and handling.

- Lock price and lead‑time in PO with terms.

- Schedule incoming QA and functional checks.

- Record lot traceability in ERP for warranty/recall.

Long‑term risk mitigation & inventory strategy

Point: Reduce future rush exposure with planning. Evidence: safety stock and qualified alternates lower urgency premiums. Explanation: use rules‑of‑thumb—safety stock = peak 90‑day usage × 0.5 for volatile SKUs, maintain 1–2 qualified alternates, and run quarterly vendor qualification and forecast cadence reviews to avoid repeated spot buys.

Summary (conclusion)

Availability and pricing pressure for the S6S1RP show up most in small‑quantity spot markets and when lead times stretch beyond typical reel allocation windows. The immediate must‑checks are: confirm Vrrm, average and surge current, gate sensitivity, and packaging/traceability before payment. Procurement should snapshot live stock daily, validate authenticity with photos and sample tests, and lock short‑term supply with PO terms when designs depend on this SCR.

Key Summary

- Monitor live quotes daily and prioritize authorized distributor stock to avoid counterfeits and high broker premiums; confirm electrical ratings before order placement.

- Validate package, marking and lot traceability; perform sample functional tests for short buys and require paperwork for larger buys to reduce risk.

- Use safety stock formula and maintain qualified alternates to mitigate lead‑time volatility and limit expensive rush purchases.

FAQ

How quickly can buyers confirm S6S1RP stock authenticity?

Answer: Buyers can perform initial authenticity checks within 24–48 hours by requesting high‑resolution photos, lot codes, and packaging details, then running a quick functional trigger test on a sample; deeper lab analysis requires extra lead time but is recommended for large buys.

What specs are critical when substituting another SCR for this SCR?

Answer: Critical substitution criteria include equal or higher Vrrm, equal or greater average and surge current ratings, compatible gate trigger sensitivity, and comparable thermal resistance and package footprint; always validate with thermal derating analysis.

When should procurement escalate a stock shortage for S6S1RP to engineering?

Answer: Escalate when quoted lead times exceed your safety‑stock window (typically beyond twice your forecast coverage) or when no traceable authorized stock is available; engineering should then evaluate alternates or temporary BOM changes.

- Technical Features of PMIC DC-DC Switching Regulator TPS54202DDCR

- STM32F030K6T6: A High-Performance Core Component for Embedded Systems

- Tamura L34S1T2D15 Datasheet Breakdown: Key Specs & Limits

- PAL6055.700HLT Datasheet: Complete Technical Report

- FDP027N08B MOSFET Datasheet Deep-Dive: Key Specs & Test Data

- LT1074IT7: Complete Specs & Key Parameters Breakdown

- How to Verify G88MP061028 Datasheet and Specs - Checklist

- NFAQ0860L36T Datasheet: Measured IPM Performance Report

- 90T03P MOSFET: Complete Specs, Pinout & Ratings Digest

- 3386F-1-101LF Datasheet & Specs — Pinout, Ratings, Sources

-

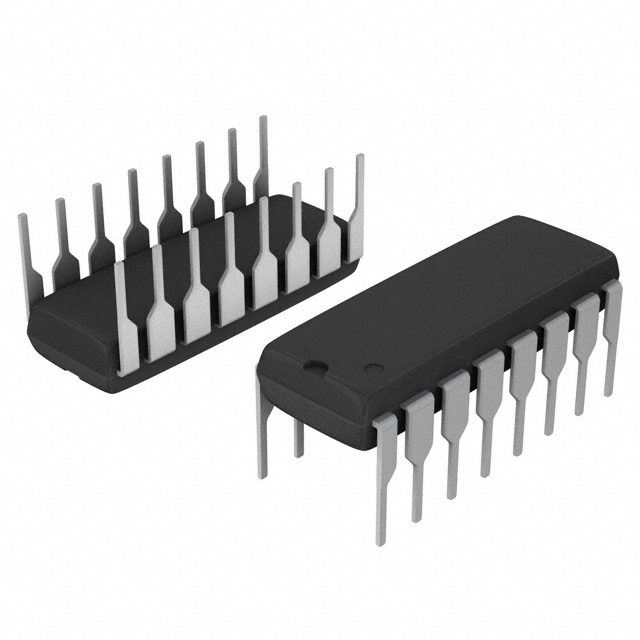

MM74HC4050NSanyo Semiconductor/onsemiIC BUFFER NON-INVERT 6V 16DIP

MM74HC4050NSanyo Semiconductor/onsemiIC BUFFER NON-INVERT 6V 16DIP -

MM74HC4049NSanyo Semiconductor/onsemiIC BUFFER NON-INVERT 6V 16DIP

MM74HC4049NSanyo Semiconductor/onsemiIC BUFFER NON-INVERT 6V 16DIP -

MM74HC4040NSanyo Semiconductor/onsemiIC BINARY COUNTER 12-BIT 16DIP

MM74HC4040NSanyo Semiconductor/onsemiIC BINARY COUNTER 12-BIT 16DIP -

MM74HC4020NSanyo Semiconductor/onsemiIC BINARY COUNTER 14-BIT 16DIP

MM74HC4020NSanyo Semiconductor/onsemiIC BINARY COUNTER 14-BIT 16DIP -

MM74HC393NSanyo Semiconductor/onsemiIC BINARY COUNTR DL 4BIT 14MDIP

MM74HC393NSanyo Semiconductor/onsemiIC BINARY COUNTR DL 4BIT 14MDIP -

MM74HC374NSanyo Semiconductor/onsemiIC FF D-TYPE SNGL 8BIT 20DIP

MM74HC374NSanyo Semiconductor/onsemiIC FF D-TYPE SNGL 8BIT 20DIP -

MM74HC373NSanyo Semiconductor/onsemiIC D-TYPE TRANSP SGL 8:8 20DIP

MM74HC373NSanyo Semiconductor/onsemiIC D-TYPE TRANSP SGL 8:8 20DIP -

LT1213CS8Linear Technology (Analog Devices, Inc.)IC OPAMP GP 2 CIRCUIT 8SO

LT1213CS8Linear Technology (Analog Devices, Inc.)IC OPAMP GP 2 CIRCUIT 8SO -

MM74HC259NSanyo Semiconductor/onsemiIC LATCH ADDRESS 8BIT 16-DIP

MM74HC259NSanyo Semiconductor/onsemiIC LATCH ADDRESS 8BIT 16-DIP -

MM74HC251NSanyo Semiconductor/onsemiIC MULTIPLEXER 1 X 8:1 16DIP

MM74HC251NSanyo Semiconductor/onsemiIC MULTIPLEXER 1 X 8:1 16DIP