-

- Contact Us

683L584P01 Availability Report: Real-Time Stock & Datasheet

Real-time inventory dynamics for electronic parts drive assembly schedules and procurement KPIs: a 48‑hour snapshot can change lead-time commitments by multiple weeks and directly affect on‑time build metrics. This report centers on the part 683L584P01, providing a timestamped availability snapshot, a datasheet checklist, procurement guidance, and an executable buyer checklist so sourcing teams can act with confidence.

Background: What is 683L584P01 — key specs & use cases

Core technical specs to pull from the datasheet

Point: Extract essential datasheet entries first. Evidence: note electrical ratings (maximum voltage/current), package type and pinout highlights, recommended operating conditions, and thermal limits—record exact datasheet section IDs and the revision/date printed on the header. Explanation: capturing section IDs and revision enables traceability when supplier specs differ and supports warranty or failure analysis later.

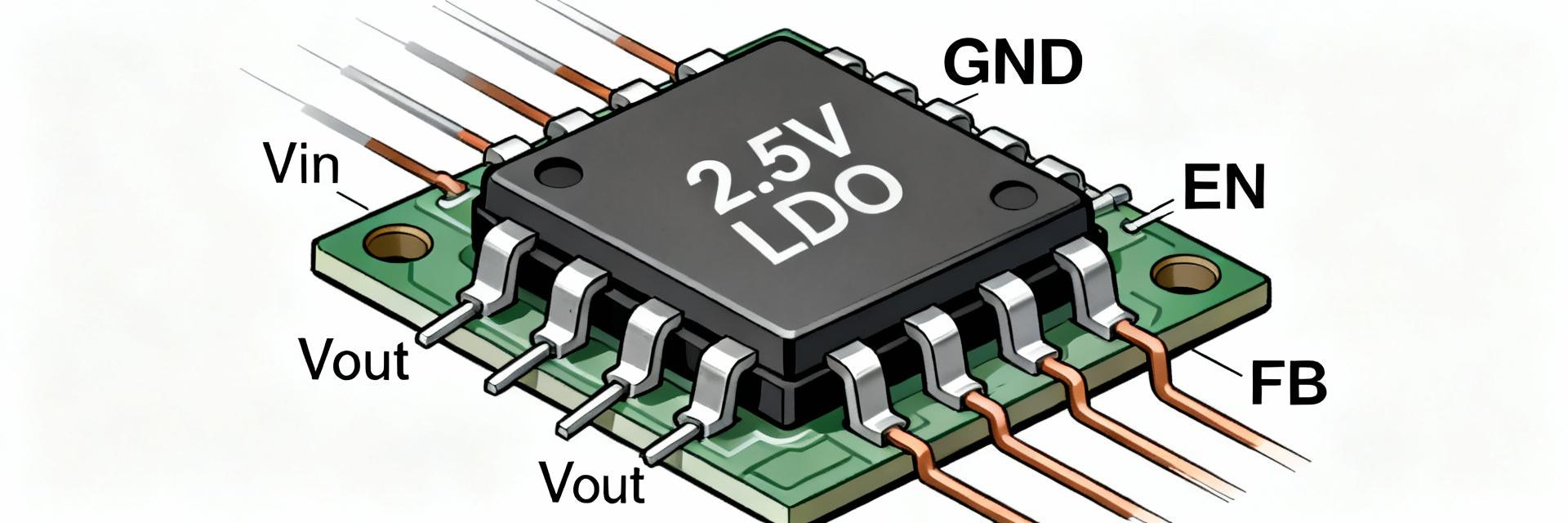

Typical applications and form-factor considerations

Point: Identify common use cases. Evidence: the part is typically used in board‑level power/analog interfaces or module integration where footprint and thermal dissipation matter. Explanation: evaluate board placement for heat sinking, check pad geometry vs. land pattern in the datasheet, and confirm any clearance or height limits to ensure compatibility with enclosures and neighboring components; availability impacts design risk.

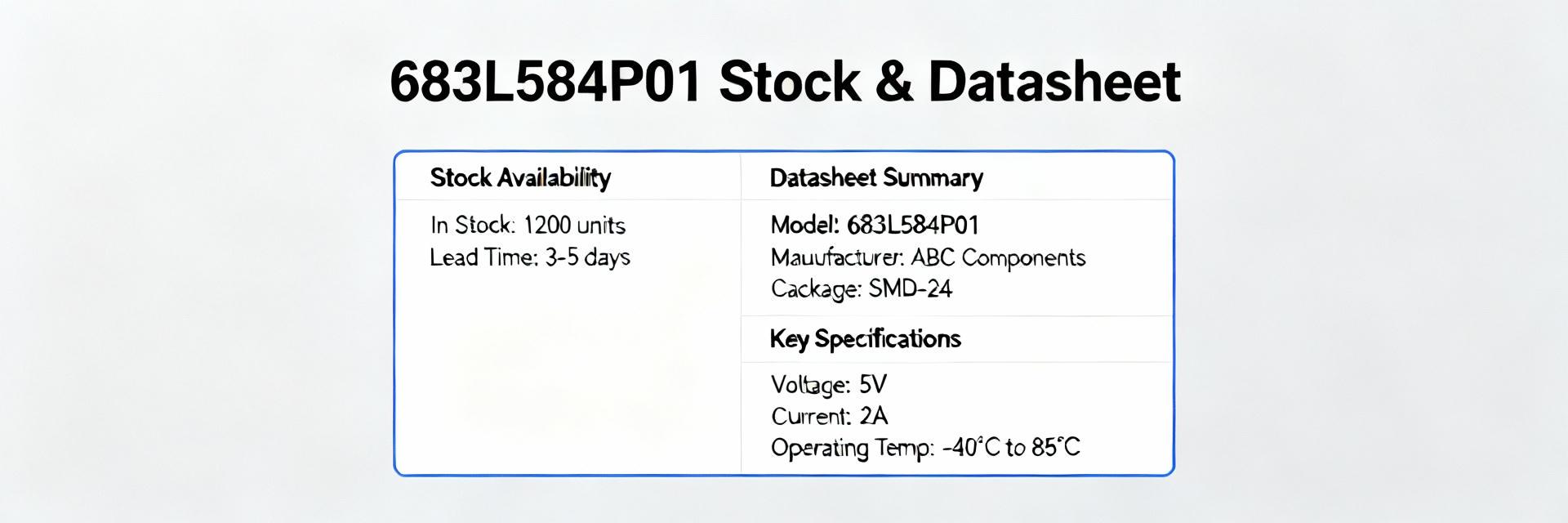

Real-Time Availability Snapshot for 683L584P01

Inventory methodology and timestamping

Point: Use repeatable collection methods. Evidence: gather data from authorized distributor APIs, inventory aggregator snapshots, and manual confirmations; always attach a last‑checked timestamp and confidence level. Explanation: recommended table columns include source type, available qty, allocated qty, lead time, price trend, and last updated—this standardizes feeds and makes discrepancies obvious.

Regional stock trends and typical US lead times

Point: Interpret regional patterns, not raw numbers. Evidence: US market observations typically show a mix of centralized warehouse pools and smaller localized stock; lead times often range from same‑week for local allocations to 8–16 weeks for allocated factory schedules depending on demand intensity. Explanation: treat fill rates conservatively—promised ship dates may reflect backorders, so convert vendor lead times into days‑of‑coverage against your BOM and plan safety stock accordingly.

Datasheet Deep-Dive: critical checks before you buy

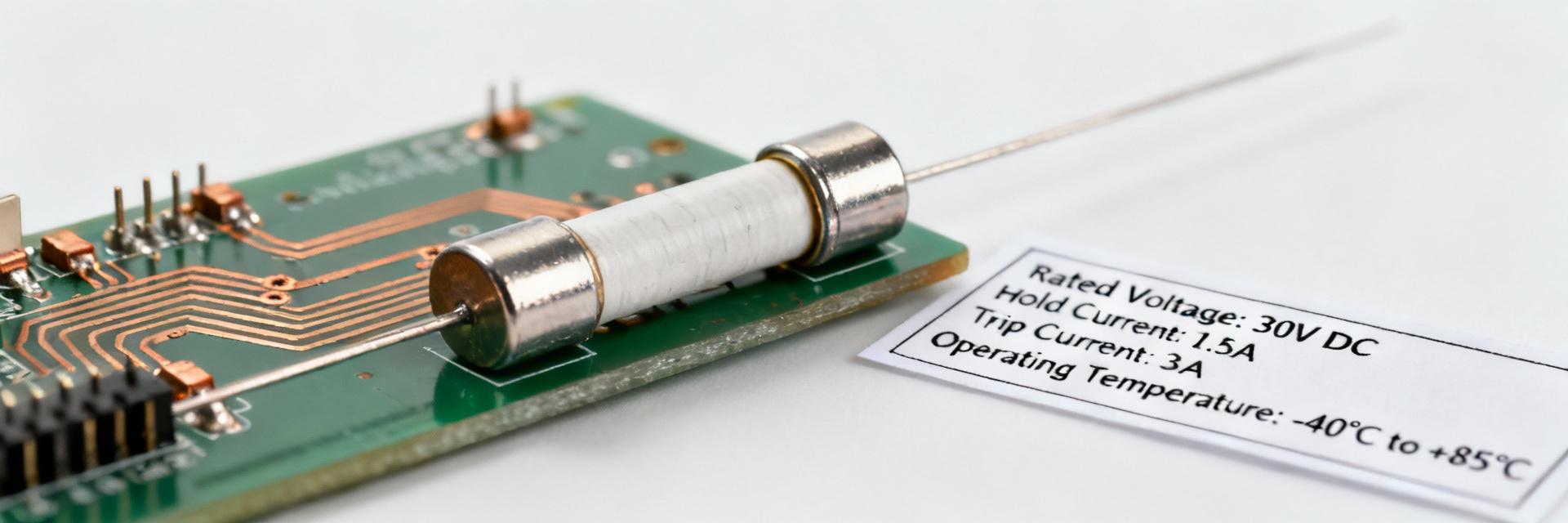

Must-verify electrical and mechanical parameters

Point: Verify the items that most frequently cause returns. Evidence: confirm absolute max ratings, tolerances, thermal resistance (θJA/θJC), pin assignments, and any frequency/S‑parameter data if applicable. Explanation: flag mismatches between vendor spec sheets and the official datasheet immediately—note the differing table/section IDs and hold orders until resolved to prevent field failures.

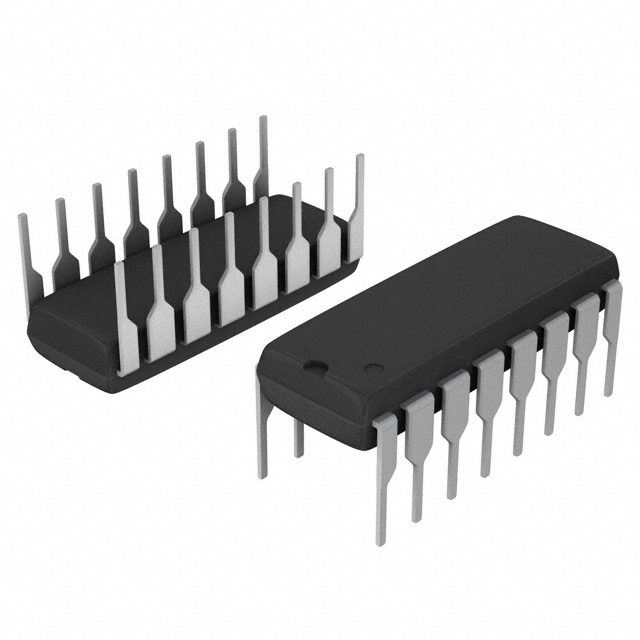

Revision codes, part markings, and cross-references

Point: Record identity markers for traceability. Evidence: read revision suffixes, date or lot codes, and physical part marking guidance in the datasheet; capture the datasheet revision and the part marking string. Explanation: include revision code and capture date in procurement documents so received parts can be validated against the expected revision and any cross‑reference mappings are auditable.

Ordering & Procurement Best Practices

Verifying stock & placing a secure order

Point: Insist on timestamped confirmations. Evidence: require suppliers to provide a timestamped stock confirmation, MOQ, confirmed lead time, and packing photos; include the datasheet revision and expected lot code on the purchase order. Explanation: these steps reduce mis-ship risk and create contractual anchors for delivery date disputes and penalties.

Risk mitigation: traceability, authenticity, and alternatives

Point: Build simple authenticity checks into the workflow. Evidence: request traceability paperwork, inspect date/lot codes and packaging, and reserve the right to sample test suspicious lots. Explanation: maintain an approved second-source list and a documented cross‑reference approach for substitutes so teams can rapidly qualify alternates when primary availability is constrained.

Case Example: interpreting a live availability report

Reading a sample inventory snapshot (columns explained)

Point: A concise snapshot should be human‑readable. Evidence: example columns—Source Type, Available Qty, Allocated Qty, Lead Time (days), Price Trend, Timestamp—let teams compare and flag conflicts by timestamp and source. Explanation: always prioritize confirmed allocations with a supporting PO anchor over mere listed stock to avoid double booking.

| Source Type | Available Qty | Allocated Qty | Lead Time | Price Trend | Timestamp |

|---|---|---|---|---|---|

| Authorized distributor | 1,200 | 200 | 7 days | stable | 2025-06-01T14:00Z |

| Inventory aggregator | 350 | 150 | 14 days | rising | 2025-06-01T13:30Z |

| Third‑party broker | 75 | 0 | 3 days | premium | 2025-06-01T12:50Z |

Decision flow: buy now vs. wait vs. qualify alternate

Point: Apply a simple rule set. Evidence: critical/low stock → expedite or qualify alternate; moderate stock → validate lead time and schedule; abundant stock → standard PO. Explanation: use coverage days and MOQ triggers (e.g., production run lot size) to determine when to expedite, negotiate penalties, or shift to a qualified substitute.

Actionable Checklist & Next Steps for buyers

7-step procurement checklist (ready-to-use)

- Request timestamped stock confirmation and include it with the PO.

- Attach the datasheet revision and part marking expectations to the PO.

- Confirm MOQ and minimum days‑of‑coverage relative to production demands.

- Request lot/date code and packaging photos before shipment.

- Negotiate lead‑time penalties or expedited options in writing.

- Log supplier contact and keep a confirmation audit trail.

- Prepare a contingency plan: pre‑qualify one alternate where feasible.

Retrieving and storing the official datasheet

Point: Archive the authoritative PDF for traceability. Evidence: obtain the official datasheet PDF from the manufacturer or an authorized repository and save a local copy with a standardized filename (e.g., PARTNUMBER_datasheet_revX_YYYYMMDD.pdf) and record capture date and internal reference. Explanation: include the file reference on the PO and in your component database so procurement and quality have a single source of truth.

Summary

- Current availability posture: treat listed stock as provisional until you secure a timestamped confirmation; plan coverage and safety stock to prevent line stoppage for 683L584P01 while watching nationwide allocation signals.

- Top datasheet items to validate: absolute maximums, thermal specs, pinout/packaging, and revision codes—capture section IDs and revision on procurement records to avoid mismatches.

- Immediate procurement actions: request timestamped stock, attach the datasheet revision to the PO, confirm lot codes, and pre‑qualify one alternate to reduce schedule risk.

FAQ

How quickly can I get confirmation of stock for this part?

Most authorized sources will provide a timestamped confirmation within 24 hours; use API snapshots for continuous monitoring and demand a written confirmation for quantities and lead times to lock dates. Treat any unconfirmed listing as tentative until you receive a dated response tied to a supplier contact.

What key datasheet items should I include on the purchase order?

Include the datasheet revision, expected part marking string, required lot/date codes, and any thermal or mounting constraints that affect acceptance. Recording these items on the PO ensures receiving and inspection teams can quickly validate incoming parts against your documented expectations.

If availability is tight, what triggers should make me qualify an alternate?

Trigger qualification when projected days‑of‑coverage drops below your safety threshold (commonly 30 days), when lead time exceeds acceptable schedule float, or when MOQ and pricing erode cost targets; document equivalency checks and test sample requirements before switching to an alternate.

- Technical Features of PMIC DC-DC Switching Regulator TPS54202DDCR

- STM32F030K6T6: A High-Performance Core Component for Embedded Systems

- Tamura L34S1T2D15 Datasheet Breakdown: Key Specs & Limits

- PAL6055.700HLT Datasheet: Complete Technical Report

- FDP027N08B MOSFET Datasheet Deep-Dive: Key Specs & Test Data

- LT1074IT7: Complete Specs & Key Parameters Breakdown

- How to Verify G88MP061028 Datasheet and Specs - Checklist

- NFAQ0860L36T Datasheet: Measured IPM Performance Report

- 90T03P MOSFET: Complete Specs, Pinout & Ratings Digest

- 3386F-1-101LF Datasheet & Specs — Pinout, Ratings, Sources

-

MM74HC4050NSanyo Semiconductor/onsemiIC BUFFER NON-INVERT 6V 16DIP

MM74HC4050NSanyo Semiconductor/onsemiIC BUFFER NON-INVERT 6V 16DIP -

MM74HC4049NSanyo Semiconductor/onsemiIC BUFFER NON-INVERT 6V 16DIP

MM74HC4049NSanyo Semiconductor/onsemiIC BUFFER NON-INVERT 6V 16DIP -

MM74HC4040NSanyo Semiconductor/onsemiIC BINARY COUNTER 12-BIT 16DIP

MM74HC4040NSanyo Semiconductor/onsemiIC BINARY COUNTER 12-BIT 16DIP -

MM74HC4020NSanyo Semiconductor/onsemiIC BINARY COUNTER 14-BIT 16DIP

MM74HC4020NSanyo Semiconductor/onsemiIC BINARY COUNTER 14-BIT 16DIP -

MM74HC393NSanyo Semiconductor/onsemiIC BINARY COUNTR DL 4BIT 14MDIP

MM74HC393NSanyo Semiconductor/onsemiIC BINARY COUNTR DL 4BIT 14MDIP -

MM74HC374NSanyo Semiconductor/onsemiIC FF D-TYPE SNGL 8BIT 20DIP

MM74HC374NSanyo Semiconductor/onsemiIC FF D-TYPE SNGL 8BIT 20DIP -

MM74HC373NSanyo Semiconductor/onsemiIC D-TYPE TRANSP SGL 8:8 20DIP

MM74HC373NSanyo Semiconductor/onsemiIC D-TYPE TRANSP SGL 8:8 20DIP -

LT1213CS8Linear Technology (Analog Devices, Inc.)IC OPAMP GP 2 CIRCUIT 8SO

LT1213CS8Linear Technology (Analog Devices, Inc.)IC OPAMP GP 2 CIRCUIT 8SO -

MM74HC259NSanyo Semiconductor/onsemiIC LATCH ADDRESS 8BIT 16-DIP

MM74HC259NSanyo Semiconductor/onsemiIC LATCH ADDRESS 8BIT 16-DIP -

MM74HC251NSanyo Semiconductor/onsemiIC MULTIPLEXER 1 X 8:1 16DIP

MM74HC251NSanyo Semiconductor/onsemiIC MULTIPLEXER 1 X 8:1 16DIP