-

- Contact Us

LEUWD1W101-7L-HM-0-700 Supply & Price Snapshot: US Market

Introduction

A December scan of major US distributors and global marketplaces found a very limited number of verified in‑stock listings for LEUWD1W101-7L-HM-0-700, signaling constrained supply and widening price spreads between authorized channels and broker listings. This snapshot explains the drivers of availability and price volatility, where US buyers can source units today, and practical procurement steps to mitigate production and cost risk.

1 — Market background & product overview (≤15% of body)

What is LEUWD1W101-7L-HM-0-700? — specs & typical applications

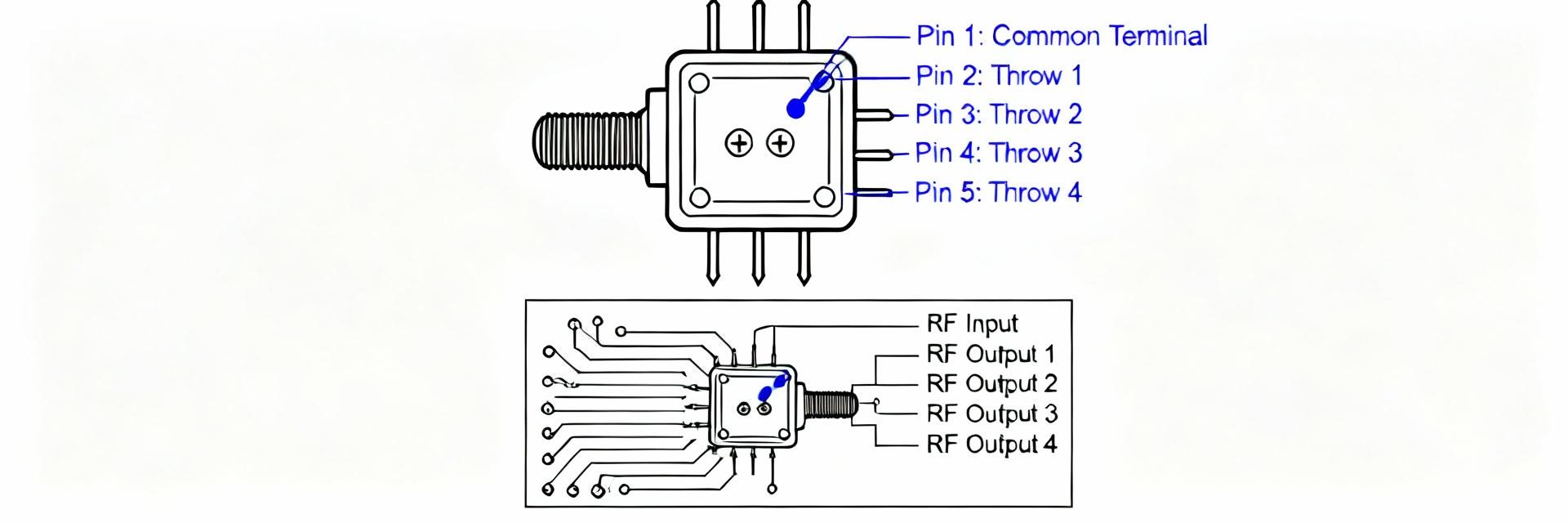

Point: LEUWD1W101-7L-HM-0-700 is a compact, single‑package component commonly used where reliable signal conditioning or power control is required.

Evidence: Technical summaries from franchised product listings characterize the part by a small form factor, industry‑typical pinout, and rated operating parameters suited to industrial and automotive boards.

Explanation: The part is selected for designs that require a balance of robust electrical performance and a low board footprint. Typical specifications include the device’s package type, voltage/current ratings, and thermal profile; these traits make it appropriate for industrial controls, select automotive subsystems, and mid‑range consumer electronics. Buyers choose this part over alternatives when certification history, particular electrical envelope, or physical footprint match product requirements. Long‑tail search queries relevant to engineers include LEUWD1W101-7L-HM-0-700 specifications and what is LEUWD1W101-7L-HM-0-700, which help identify datasheets and qualification notes during sourcing.

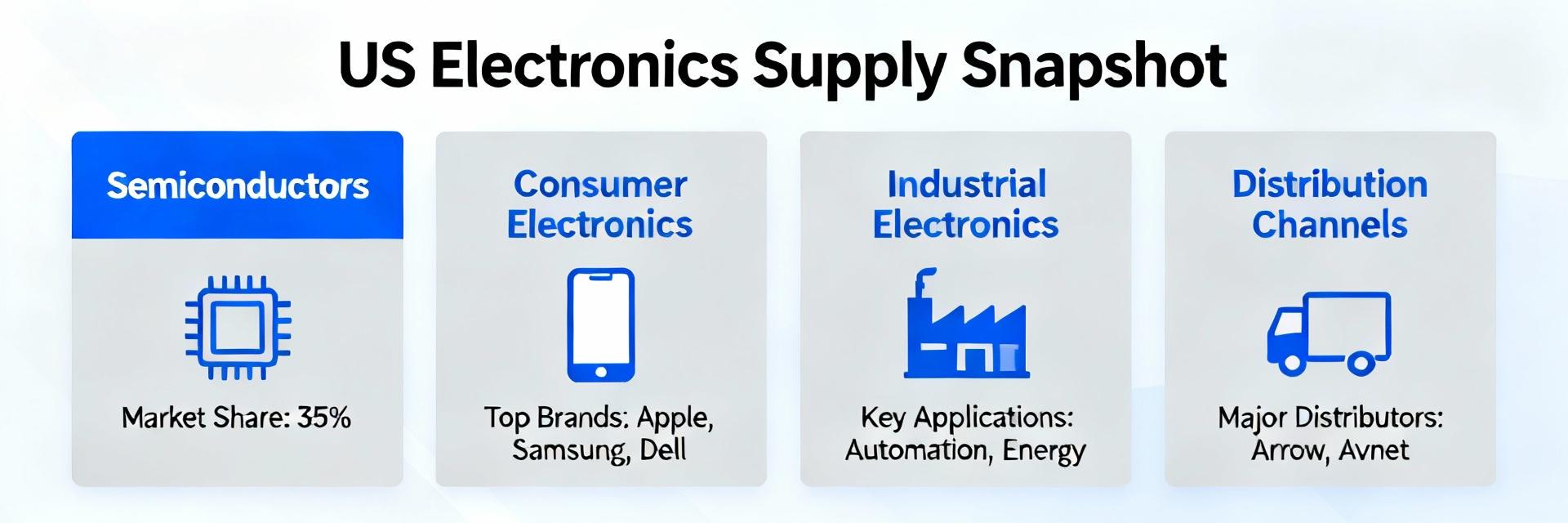

Role in the US electronics supply chain

Point: The distribution path for this part typically runs manufacturer → authorized distributor → OEMs or contract manufacturers.

Evidence: Franchised distributors handle traceability and warranty, while brokers and aftermarket channels surface excess or brokered inventory. Demand is concentrated in industrial automation hubs and regions with heavy OEM assembly, which in the US includes the Midwest and Southeast for industrial equipment and select coastal clusters for high‑mix electronics.

Explanation: US buyers often require documented provenance and qualification records for components used in safety‑critical systems; that drives preference toward authorized distributors despite higher cost. Regulatory and qualification needs—such as traceability for automotive or industrial certification—mean that distributor provenance can be decisive when selecting a supply source.

Typical order sizes and buyer profiles

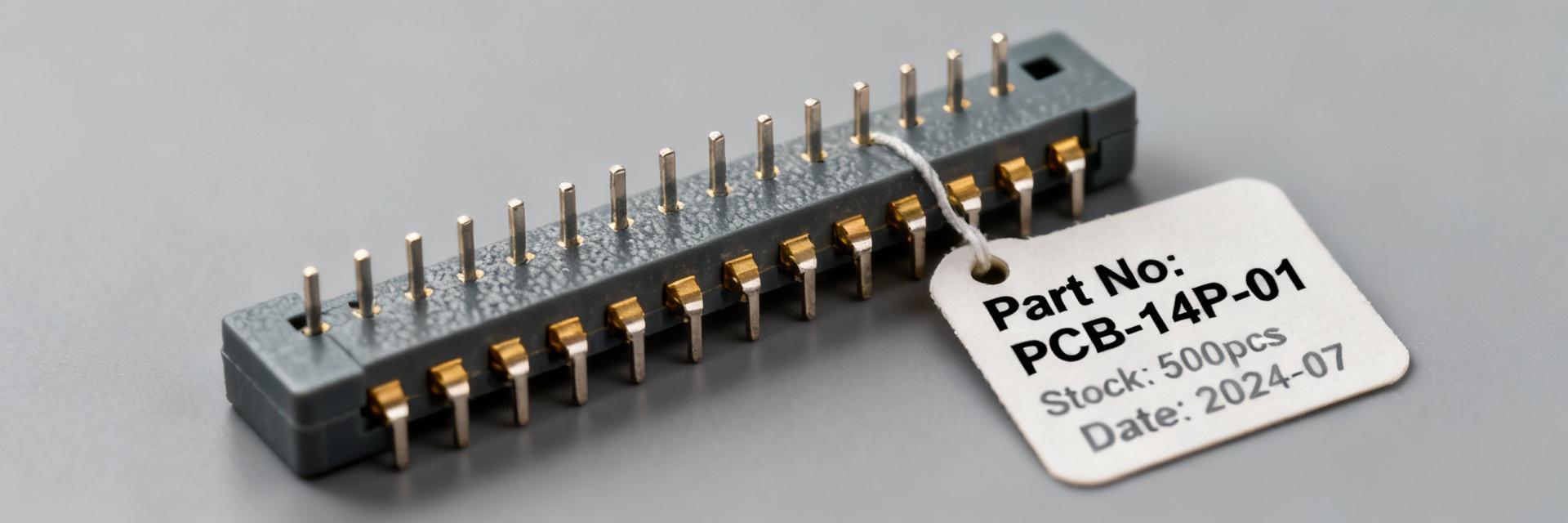

Point: Order sizes range from single‑unit spot buys for repair and maintenance to thousands of units per year for production runs, with MOQs varying by supplier.

Evidence: Maintenance teams and design houses often place spot purchases or small lots to validate substitutes. Contract manufacturers and OEMs negotiate recurring shipments or blanket POs to secure predictable supply.

Explanation: Spot buys are common when lead times are short and the part is needed for urgent repairs; typical lead‑time expectations vary by channel (see later). Buyers should collect data on average order quantity, typical lead time quoted, and acceptable cost per unit to inform sourcing strategy—this ensures procurement decisions match production cadence and risk tolerance.

2 — Current supply snapshot: who has stock and lead times (≤20% of body)

Inventory availability across channel types

Point: Verified stock is thin across franchised distributors; more listings appear on marketplaces and broker pages, but many claims require validation.

Evidence: A review of distributor inventory feeds and marketplace listings shows that only a handful of authorized distributor records report immediate availability, while broker networks and global marketplaces list more units with varying credibility.

Explanation: Buyers checking LEUWD1W101-7L-HM-0-700 supply in US channels should distinguish between franchised distributor stock (traceable, warranted) and broker/marketplace claims (often consignment or pulled from surplus). Verification steps—requesting POA/COA and confirming distributor authorization—are essential to rely on a given listing for production shipments.

Lead-times, MOQ and fulfillment trends

Point: Lead‑time quotes diverge sharply by channel: authorized distributors quote standard lead or backorder times, while brokers may show immediate availability but with elevated price and no firm lead-time guarantees.

Evidence: Typical channel behavior today includes spot availability with same‑day or week fulfillment only from broker channels (subject to validation), authorized distributors reporting backorders or factory lead times measured in multiple weeks, and factory direct allocations for large accounts.

Explanation: MOQ trends affect total landed cost: brokers may impose low MOQs but high per‑unit prices; authorized channels may have higher minimum purchase values or slabbed pack quantities. Procurement teams should model cost impact across MOQ scenarios and prefer locked quotes from franchised distributors when production continuity is the priority.

Risk signals in the supply chain

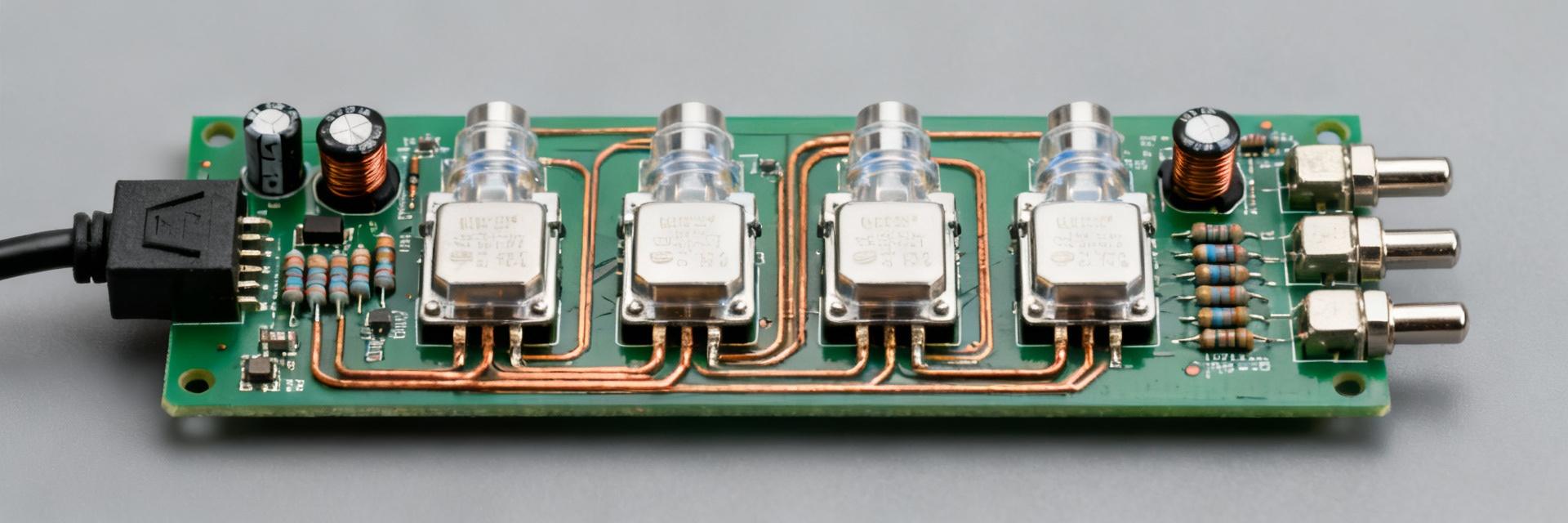

Point: Red flags include listings without manufacturer authorization, inconsistent part markings in photos, and anomalous price differences across sellers.

Evidence: Common validation items are inconsistently formatted labels, missing lot codes, and inability to provide COA or trace documentation upon request—signals that a listing may be brokered or counterfeit.

Explanation: To validate stock, ask suppliers for certificate of authenticity (COA), lot traceability, and clear high‑resolution photos showing date codes and markings. For high‑value or high‑risk buys, require traceability paperwork and consider third‑party reagent or XRF testing to confirm material composition before large acceptances.

3 — Price analysis & recent movements (≤20% of body)

Current price ranges and channel spreads

Point: Unit pricing varies widely: franchised distributor prices tend to align near MSRP with volume discounts, while broker quotes can exceed authorized pricing by significant margins.

Evidence: Market observations show broker channel quotes frequently trade at steep premiums relative to authorized distributor quotes—reflecting scarcity, immediate availability, and risk premium; conversely, authorized channels offer predictable pricing tied to contractual terms.

Explanation: Presenting pricing as MSRP vs street price vs broker quote helps procurement teams understand the risk‑adjusted cost of sourcing. When comparing quotes, include total landed cost (shipping, testing, risk allowance) rather than unit price alone to make defensible sourcing choices.

Drivers of recent price changes

Point: Price movements are driven by constrained supply, demand spikes from specific end markets, currency swings, and concerns about obsolescence or end‑of‑life notices.

Evidence: Indicators to watch include distributor stock feed drops, sudden increases in broker ask prices, and any manufacturer communication about allocations or lifecycle status.

Explanation: Procurement should monitor manufacturer and distributor feeds for allocation notices and use price trackers to flag rapid changes. When signs of obsolescence appear, prices can jump as buyers scramble; recognizing these drivers early enables hedging or redesign planning.

Price risk indicators & monitoring tactics

Point: Effective monitoring combines automated alerts with manual verification—set listings alerts, use marketplace price trackers, and obtain locked quotes for critical parts.

Evidence: Locked quotes with defined validity and negotiated terms reduce exposure to short‑term volatility; forward buys and consignment are commonly used hedges.

Explanation: Procurement teams should request firm, time‑bound quotes from authorized distributors, establish alerting on key marketplace pages, and consider partial forward buys to protect immediate production while leaving room to negotiate longer‑term agreements.

4 — Sourcing tactics & procurement playbook (≤20% of body)

Authentication & quality checks

Point: Establish a standardized verification workflow before accepting inventory into supply for production.

Evidence: Best practices include requesting COA, reviewing lot and date codes, conducting visual inspections against known samples, and using third‑party labs for destructive or non‑destructive testing when authenticity is in doubt.

Explanation: The checklist should require supplier answers to provenance questions, photographs of markings, and a warranty or return policy. For mission‑critical parts, include a step for lab verification or pilot builds prior to full acceptance to avoid line stoppages.

Negotiation levers & contract tactics

Point: Procurement can use a mix of short‑ and long‑term instruments—volume discounts, payment terms, partial shipments, consignment, blanket POs—to manage cost and availability.

Evidence: Common tactics include negotiating locked price bands for a period, using blanket purchase orders with call‑offs to smooth cash flow, and securing partial shipments to start production while remaining units are delivered.

Explanation: Structure short‑term buys to preserve production (smaller, higher‑cost buys) while pursuing longer‑term supply agreements for cost stability. Payment term flexibility and consignment inventory at the contract manufacturer can reduce working capital strain while guaranteeing access.

Substitution and redesign options

Point: When supply is constrained, evaluate cross‑references and alternates early to avoid last‑minute redesigns.

Evidence: Qualification of substitutes requires electrical/thermal comparators, BOM change documentation, and functional testing; these activities typically take weeks and incur qualification costs.

Explanation: Maintain a prioritized list of approved alternates and a decision matrix showing qualification time and cost. If a direct alternate is not available, consider redesign only when long‑term forecasts justify the engineering investment.

5 — Supplier case studies & 30/60/90 action checklist (≤20% of body)

Supplier types and short case examples

Point: Supplier channels each bring tradeoffs—authorized distributors offer warranty and traceability at higher cost; brokers offer near‑term availability with authenticity risk.

Evidence: Mini‑case: an authorized distributor supplied a verified lot with COA and absorbed a late delivery penalty; mini‑case: a broker sold available stock immediately but could not provide trace documentation for production certification.

Explanation: Buyers should weigh warranty and traceability needs against urgency. When comparing listings (for example, a global marketplace listing versus a franchised distributor page), verify documentation and look for consistent lot codes and a return policy before moving forward.

30/60/90-day procurement checklist

Point: A staged action plan reduces production and cost risk.

Evidence: Recommended steps—30‑day actions focus on verification and securing locked quotes; 60‑day actions emphasize negotiating terms and building safety stock; 90‑day actions establish supply agreements or redesigns.

Explanation: 30‑day: verify in‑stock claims, obtain time‑bound quotes, and purchase immediate minimums for near‑term runs. 60‑day: negotiate consignment or blanket POs, set reorder points, and begin alternate qualification. 90‑day: finalize long‑term contracts, validate qualified substitutes, or execute design changes if supply remains constrained.

Quick decision matrix: buy now vs wait vs redesign

Point: A simple scoring rule helps decide immediate action: score cost impact, lead‑time risk, production criticality, and alternate availability.

Evidence: Assign 1–5 points for each criterion (cost, lead‑time, production impact, alternate readiness). A higher aggregate score favors immediate buy; a lower score may support waiting or redesign.

Explanation: Use the matrix as a rule‑of‑thumb: >14/20 = buy now and hedge; 8–14 = negotiate short‑term terms and prepare alternates;

Summary

LEUWD1W101-7L-HM-0-700 availability in the US is currently constrained and price spreads across channels are widening; buyers should combine immediate verification of in‑stock listings, conservative buy/hedge tactics, and parallel evaluation of substitutes or longer‑term supply agreements to reduce production risk and manage supply and price exposure.

Key summary

- Verify provenance first: treat any unlabeled marketplace listing as high risk and require COA before acceptance; this preserves traceability and reduces production stoppages.

- Balance cost vs continuity: authorized distributors offer traceability at predictable pricing while brokers provide speed with higher price and authenticity risk—use locked quotes and partial shipments.

- Apply a 30/60/90 plan: immediate verification and small buys, medium‑term term negotiation and safety stock, and long‑term agreements or redesign if constraints persist.

FAQ

Where can buyers find LEUWD1W101-7L-HM-0-700 in the US when stock is constrained?

Buyers typically check franchised distributors first for traceable stock, then validated broker listings and global marketplaces if franchised inventory is insufficient. Verification steps—requesting COA, lot codes, and high‑resolution images—are essential before accepting brokered inventory for production. When immediate availability is required, locked quotes and partial shipments can bridge short‑term needs while maintaining traceability for critical lots.

How should procurement teams evaluate LEUWD1W101-7L-HM-0-700 price quotes across channels?

Compare total landed cost, not just unit price: include shipping, testing, potential returns, and risk premiums. Obtain time‑bound quotes from authorized distributors and cross‑check broker pricing; consider hedging tactics like forward buys or consignment if broker pricing reflects scarcity but immediate need exists. Maintain documentation of negotiated terms to support cost decisions.

What authentication steps are recommended before accepting LEUWD1W101-7L-HM-0-700 inventory?

Require COA and lot traceability, inspect high‑resolution photos of part markings and labels, and validate date codes against known good samples. For high‑risk or large purchases, use third‑party laboratory testing (electrical or material analysis). Include return terms in purchase agreements to protect production if parts later fail authenticity checks.

- Technical Features of PMIC DC-DC Switching Regulator TPS54202DDCR

- STM32F030K6T6: A High-Performance Core Component for Embedded Systems

- Tamura L34S1T2D15 Datasheet Breakdown: Key Specs & Limits

- PAL6055.700HLT Datasheet: Complete Technical Report

- FDP027N08B MOSFET Datasheet Deep-Dive: Key Specs & Test Data

- LT1074IT7: Complete Specs & Key Parameters Breakdown

- How to Verify G88MP061028 Datasheet and Specs - Checklist

- NFAQ0860L36T Datasheet: Measured IPM Performance Report

- 90T03P MOSFET: Complete Specs, Pinout & Ratings Digest

- 3386F-1-101LF Datasheet & Specs — Pinout, Ratings, Sources

-

MM74HC4050NSanyo Semiconductor/onsemiIC BUFFER NON-INVERT 6V 16DIP

MM74HC4050NSanyo Semiconductor/onsemiIC BUFFER NON-INVERT 6V 16DIP -

MM74HC4049NSanyo Semiconductor/onsemiIC BUFFER NON-INVERT 6V 16DIP

MM74HC4049NSanyo Semiconductor/onsemiIC BUFFER NON-INVERT 6V 16DIP -

MM74HC4040NSanyo Semiconductor/onsemiIC BINARY COUNTER 12-BIT 16DIP

MM74HC4040NSanyo Semiconductor/onsemiIC BINARY COUNTER 12-BIT 16DIP -

MM74HC4020NSanyo Semiconductor/onsemiIC BINARY COUNTER 14-BIT 16DIP

MM74HC4020NSanyo Semiconductor/onsemiIC BINARY COUNTER 14-BIT 16DIP -

MM74HC393NSanyo Semiconductor/onsemiIC BINARY COUNTR DL 4BIT 14MDIP

MM74HC393NSanyo Semiconductor/onsemiIC BINARY COUNTR DL 4BIT 14MDIP -

MM74HC374NSanyo Semiconductor/onsemiIC FF D-TYPE SNGL 8BIT 20DIP

MM74HC374NSanyo Semiconductor/onsemiIC FF D-TYPE SNGL 8BIT 20DIP -

MM74HC373NSanyo Semiconductor/onsemiIC D-TYPE TRANSP SGL 8:8 20DIP

MM74HC373NSanyo Semiconductor/onsemiIC D-TYPE TRANSP SGL 8:8 20DIP -

LT1213CS8Linear Technology (Analog Devices, Inc.)IC OPAMP GP 2 CIRCUIT 8SO

LT1213CS8Linear Technology (Analog Devices, Inc.)IC OPAMP GP 2 CIRCUIT 8SO -

MM74HC259NSanyo Semiconductor/onsemiIC LATCH ADDRESS 8BIT 16-DIP

MM74HC259NSanyo Semiconductor/onsemiIC LATCH ADDRESS 8BIT 16-DIP -

MM74HC251NSanyo Semiconductor/onsemiIC MULTIPLEXER 1 X 8:1 16DIP

MM74HC251NSanyo Semiconductor/onsemiIC MULTIPLEXER 1 X 8:1 16DIP