-

- Contact Us

Supply Availability: US Market Report - Lead Time Risks

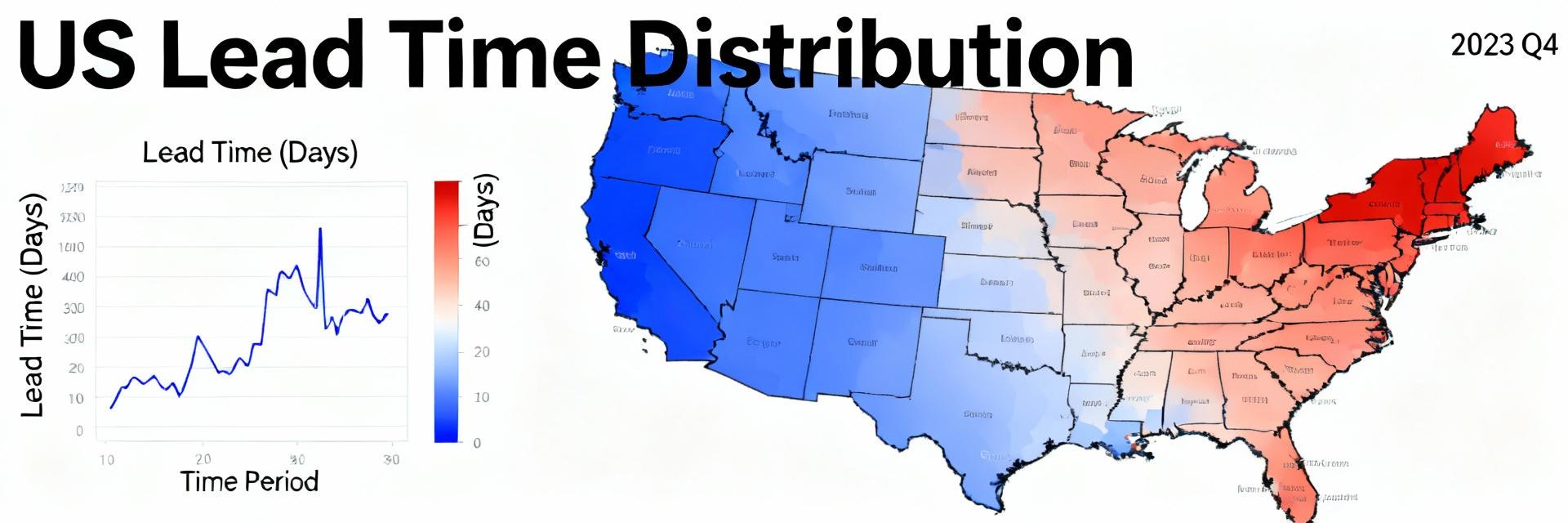

Average lead times and fill-rate variability have trended upward across multiple US market corridors, with supplier concentration and logistics chokepoints amplifying downstream risk. This report uses a data-driven lens to establish urgency: rising median lead times, widening 90th-percentile tails, and increased frequency of expedited shipments indicate structural fragility. Readers will receive a clear view of the current state, a practical data analysis approach, mapped risk drivers, scenario stress tests, and an actionable playbook for procurement and operations. Supply Availability is addressed with concrete next steps throughout.

1 — Background: Current state of supply availability in the US market

Supply availability in the US market varies by sector but shows common signals: longer median lead times, higher variance, and growing supplier concentration in critical components. Measurement conventions differ by team, so consistent baselines are essential: use rolling 30/90-day medians for lead times, 90th-percentile for tail risk, and per-SKU aggregation for operational decisions. Present baselines as time series and percentiles to distinguish trend from seasonality and noise; this clarifies where tactical interventions are needed versus strategic redesign.

1.1 — Key definitions & metrics to track

Define metrics unambiguously: "Supply Availability" = probability an order is fulfilled on-time at requested quantity; "lead times" = order-to-delivery elapsed working days; fill rate = % of demanded units shipped; inventory days = average days of cover; supplier concentration = share of volume by top suppliers; in-transit time = physical transit leg duration. Adopt rolling averages and percentile reporting; prefer per-SKU metrics for action and aggregated views for executive summaries. These conventions reduce metric ambiguity across teams.

- Next steps: Request per-SKU rolling 30/90-day median and 90th-percentile lead times, fill-rate by SKU, and supplier-concentration ratios for the top 200 SKUs within 7 days.

1.2 — Typical supply chain topology & chokepoints in the US market

Typical topology: tiered suppliers → consolidation hubs → ocean/air ports or rail terminals → inland intermodal and regional DCs → last-mile trucking. Chokepoints often occur at port gates, intermodal yards, and regional trucking capacity tightness; variability commonly originates in supplier prep time and port dwell. Audit nodes that combine high volume and low redundancy—these are primary vulnerability points. Operational teams should map physical flows to the KPI baselines to locate friction points quickly.

- Next steps: Create a one-page supply-chain diagram for top-50 SKUs and run a node-audit checklist (supplier lead time, port dwell, transit variance, last-mile capacity) within 14 days.

2 — Data analysis: Trends, magnitude & sector breakdown

Quantitative analysis should separate central tendencies from tail behavior and sector-specific drivers. Use freight indices, customs throughput, supplier lead-time surveys, and internal ERP lead-time logs to triangulate trends. Time-series charts must show median and 90th-percentile lead times, coefficient of variation, and moving averages to reveal volatility and structural shifts. Interpreting inflection points requires looking for concurrent signals (e.g., rising port dwell and increased expedited shipments) that indicate systemic stress rather than isolated supplier issues.

2.1 — Overall lead-time trends and volatility analysis

Recommended visualizations: median vs 90th-percentile lead-time series, rolling CV (coefficient of variation), and a stacked chart of expedited-shipment share. Volatility spikes that persist beyond seasonal windows often mark capacity slips or policy impacts. Identify seasonality using year-over-year bands and mark inflection points with annotations that show correlating logistics or supplier events. Clear visuals shorten decision cycles and support targeted mitigation.

- Next steps: Produce median and 90th-percentile lead-time charts for core SKU families and compute CV for each family; deliver within 10 business days.

2.2 — Sector-by-sector comparisons (high-risk vs low-risk sectors)

Analyze sectors separately: electronics (long global BOMs, high vendor concentration), automotive (tight JIT cadence), construction materials (bulk shipping sensitivity), pharmaceuticals (regulatory handling), and consumer goods (demand seasonality). For each, report avg lead time, 90th-percentile, CV, and supplier concentration ratio. Rank sectors by a composite lead-time risk score to prioritize interventions. A heatmap or ranked table signals where procurement and operations should allocate attention and capital.

| Sector | Avg Lead Time | 90th %-ile | Supplier Concentration |

|---|---|---|---|

| Electronics | Long | Long tail | High |

| Automotive | Medium | Spiky | Medium-High |

| Consumer Goods | Short-Medium | Moderate | Low-Medium |

- Next steps: Deliver a sector heatmap ranking lead-time risk for 6 sectors and recommend top-3 sector-specific levers within 14 days.

3 — Risk assessment: Drivers of lead-time risk & vulnerability mapping

Risk assessment separates demand-side amplification from supply-side constraints and then maps vulnerabilities by likelihood × impact. Use supplier concentration indices, lead-time decomposition, and demand skew metrics to produce a vulnerability matrix. Quantify per-SKU exposure combining criticality (revenue/service impact) with volatility and single-source dependency. The resulting map drives prioritized mitigation—where to add buffer, where to diversify suppliers, and where to invest in visibility.

3.1 — Demand-side drivers and amplification effects

Demand shocks—surge orders, forecasting errors, or order-smoothing failures—amplify lead times through capacity starvation and expedited shipping cascades. Track demand skew, forecast error (MAPE), and expedited shipment frequency to quantify amplification. A simple per-SKU risk score = forecast error percentile × expedited frequency provides a pragmatic demand-driven risk indicator for allocation of buffer stock and forecasting improvements.

- Next steps: Compute per-SKU forecast error and expedited frequency for top-200 SKUs and rank by demand amplification within 10 days.

3.2 — Supply-side drivers and logistics bottlenecks

Supply constraints arise from capacity loss, raw material shortages, single-source dependencies, and logistics choke points like port congestion. Decompose lead time into supplier prep, transit, customs, and last-mile to isolate root causes. Use a Herfindahl-style supplier concentration index for the top suppliers per SKU and a vulnerability matrix mapping likelihood × impact to prepare supplier-specific remediation plans.

- Next steps: Run lead-time decomposition for top-50 critical SKUs and compute supplier-concentration indices; present vulnerability matrix to stakeholders within 14 days.

4 — Scenario modeling & stress-testing lead times

Scenario modeling reveals which nodes and SKUs break under stress. Build concrete short-term shock scenarios (port closure, 30–60% supplier capacity loss, sudden demand surge) with clear input parameters and KPIs affected. Use Monte Carlo to capture variability, queuing models for port transit, and rolling-window forecasts for near-term lead-time prediction. Scenario outputs should feed operational playbooks and SLA negotiations with suppliers.

4.1 — Short-term shock scenarios to model

Model scenarios with defined assumptions: example—port closure for 7–21 days (assume 40% throughput reduction, +30% inland truck dwell), or supplier capacity loss of 30–60% (assume reallocation time and ramp-up). For each, report impacted SKUs, expected days of stockout, and incremental expedited cost. Scenarios inform whether to shift to alternative routing, temporary local sourcing, or prioritized allocation of constrained supply.

- Next steps: Run three prioritized scenarios (port closure, supplier capacity loss, demand surge) on top-50 SKUs and produce an impact dashboard within 14–21 days.

4.2 — Modeling approaches and early-warning indicators

Preferred models: Monte Carlo for probabilistic tails, queuing models for terminal congestion, and rolling-window ARIMA or exponential-smoothing for short-term lead-time forecasting. Early-warning indicators include rising supplier lead-time variance, a drop in on-time shipment rate, and a sustained increase in expedited shipments. Set thresholds (e.g., 90th-percentile lead time +20% vs baseline) that automatically trigger escalation and contingency playbooks.

- Next steps: Implement three leading indicators with automated alerts and define escalation thresholds; pilot on critical SKU families within 30 days.

5 — Actionable playbook: Mitigation tactics for procurement & operations

Mitigation must be tactical and measurable: prioritize supplier risk scoring, pilot multi-sourcing for highest-criticality SKUs, and optimize safety stock dynamically using service-level-driven calculations. Contracts should include lead-time SLAs with incentives and penalties tied to calibrated performance bands. Nearshoring analysis should be ROI-driven, comparing landed cost, lead-time reduction, and inventory-carry trade-offs.

5.1 — Procurement & sourcing tactics

Key tactics: implement multi-sourcing for top-10 critical SKUs, optimize safety stock using stochastic demand modeling, deploy dynamic reorder points tied to real-time lead-time forecasts, and negotiate SLAs with lead-time clarity. Use a supplier risk scorecard that weights concentration, on-time performance, and financial health. Prioritize initiatives by expected ROI—reduced expedited spend, improved fill rate, and lower stockout days.

- Next steps: Build supplier risk scorecards and run an ROI shortlist for multi-sourcing top-10 critical SKUs within 30 days.

5.2 — Operations & logistics responses

Operational responses: rebalance inventory across DCs to match demand signals, optimize transit modes for cost/time trade-offs, activate alternative routings during port stress, and use flexible warehousing contracts near demand clusters. Track post-implementation KPIs: reduction in 90th-percentile lead time, improved fill rate, and lower expedited shipping spend. A 30/60/90 tactical plan accelerates impact and creates measurable checkpoints.

- Next steps: Implement a 30/60/90 operations plan: (30) audit buffers, (60) re-route top flows, (90) measure KPI deltas and iterate.

Summary

- Implement supplier risk scoring and per-SKU lead-time decomposition within 30 days to identify top failure points and prioritize mitigation investments for improved Supply Availability across the US market.

- Pilot multi-sourcing and dynamic safety-stock optimization for the top-10 SKUs by criticality; measure expected ROI in reduced expedited spend and improved fill rates over a 60–90 day window.

- Deploy a lead-time monitoring dashboard with three early-warning indicators and defined escalation thresholds to enable rapid operational response and reduce 90th-percentile lead-time exposure.

Frequently Asked Questions

How should I assess supply availability risk for my SKU portfolio?

Assess by combining per-SKU criticality (revenue/service impact), supplier concentration index, and lead-time volatility (median and 90th-percentile). Calculate a composite risk score and map SKUs into high/medium/low buckets to prioritize sourcing and inventory actions. Recompute monthly to capture changing supplier and market conditions.

What metrics best predict worsening lead times in the US market?

Leading metrics include rising supplier lead-time variance, a sustained increase in expedited-shipment frequency, declining on-time shipment rate, and growing port or terminal dwell times. Monitor these together with demand forecast error to distinguish demand-driven from supply-driven deterioration.

Which quick wins improve supply availability most effectively?

Quick wins: implement supplier risk scorecards, secure secondary suppliers for top-critical SKUs, and adjust safety stock dynamically for items with high forecast error or long tail lead times. These steps typically reduce stockouts and expedited spend within 30–90 days when executed with clear KPIs.

- Technical Features of PMIC DC-DC Switching Regulator TPS54202DDCR

- STM32F030K6T6: A High-Performance Core Component for Embedded Systems

- Tamura L34S1T2D15 Datasheet Breakdown: Key Specs & Limits

- PAL6055.700HLT Datasheet: Complete Technical Report

- FDP027N08B MOSFET Datasheet Deep-Dive: Key Specs & Test Data

- LT1074IT7: Complete Specs & Key Parameters Breakdown

- How to Verify G88MP061028 Datasheet and Specs - Checklist

- NFAQ0860L36T Datasheet: Measured IPM Performance Report

- 90T03P MOSFET: Complete Specs, Pinout & Ratings Digest

- 3386F-1-101LF Datasheet & Specs — Pinout, Ratings, Sources

-

MM74HC4050NSanyo Semiconductor/onsemiIC BUFFER NON-INVERT 6V 16DIP

MM74HC4050NSanyo Semiconductor/onsemiIC BUFFER NON-INVERT 6V 16DIP -

MM74HC4049NSanyo Semiconductor/onsemiIC BUFFER NON-INVERT 6V 16DIP

MM74HC4049NSanyo Semiconductor/onsemiIC BUFFER NON-INVERT 6V 16DIP -

MM74HC4040NSanyo Semiconductor/onsemiIC BINARY COUNTER 12-BIT 16DIP

MM74HC4040NSanyo Semiconductor/onsemiIC BINARY COUNTER 12-BIT 16DIP -

MM74HC4020NSanyo Semiconductor/onsemiIC BINARY COUNTER 14-BIT 16DIP

MM74HC4020NSanyo Semiconductor/onsemiIC BINARY COUNTER 14-BIT 16DIP -

MM74HC393NSanyo Semiconductor/onsemiIC BINARY COUNTR DL 4BIT 14MDIP

MM74HC393NSanyo Semiconductor/onsemiIC BINARY COUNTR DL 4BIT 14MDIP -

MM74HC374NSanyo Semiconductor/onsemiIC FF D-TYPE SNGL 8BIT 20DIP

MM74HC374NSanyo Semiconductor/onsemiIC FF D-TYPE SNGL 8BIT 20DIP -

MM74HC373NSanyo Semiconductor/onsemiIC D-TYPE TRANSP SGL 8:8 20DIP

MM74HC373NSanyo Semiconductor/onsemiIC D-TYPE TRANSP SGL 8:8 20DIP -

LT1213CS8Linear Technology (Analog Devices, Inc.)IC OPAMP GP 2 CIRCUIT 8SO

LT1213CS8Linear Technology (Analog Devices, Inc.)IC OPAMP GP 2 CIRCUIT 8SO -

MM74HC259NSanyo Semiconductor/onsemiIC LATCH ADDRESS 8BIT 16-DIP

MM74HC259NSanyo Semiconductor/onsemiIC LATCH ADDRESS 8BIT 16-DIP -

MM74HC251NSanyo Semiconductor/onsemiIC MULTIPLEXER 1 X 8:1 16DIP

MM74HC251NSanyo Semiconductor/onsemiIC MULTIPLEXER 1 X 8:1 16DIP