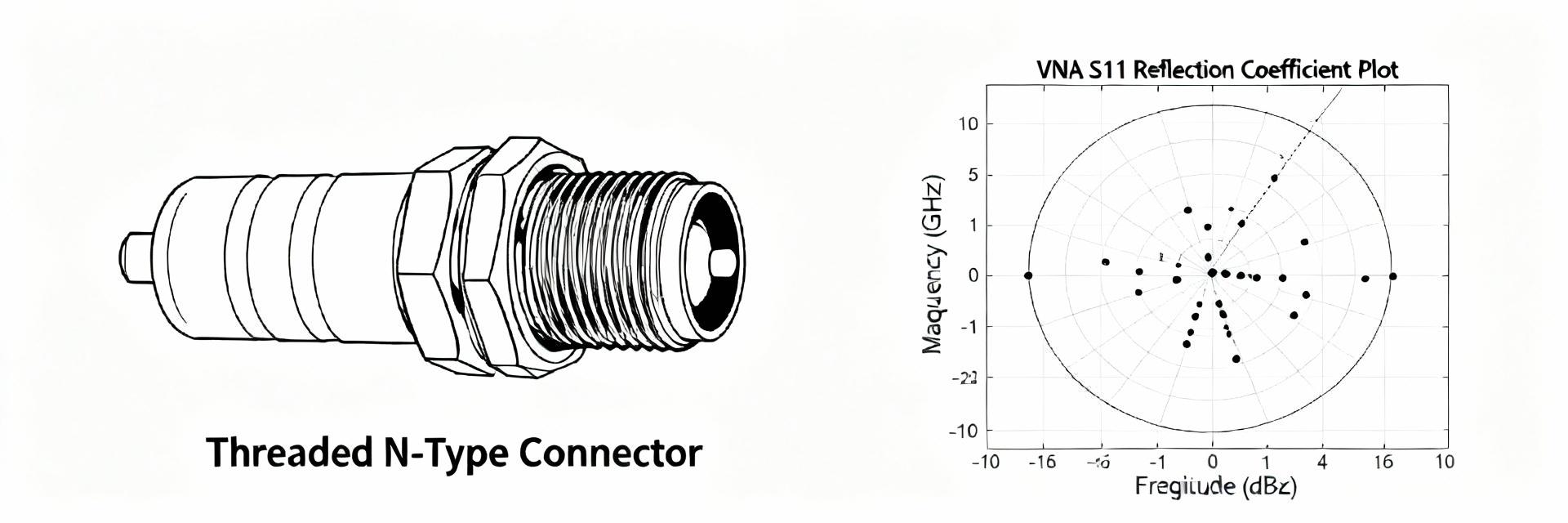

Point: This guide presents a concise, data-driven breakdown for the 5225392-2 N-Type connector to help RF engineers validate assemblies and avoid field failures. Evidence: Recent lab comparisons show repeatable 50 Ω performance to ~11 GHz with insertion loss often under 0.3 dB. Explanation: The focus is on extracting datasheet values, defining test methods, and interpreting measurement trends. Point: The article is practical and US-oriented, prioritizing measurable acceptance criteria and repeatable procedures. Evidence: It emphasizes VNA calibration, DC checks, and statistical reporting for production lots. Explanation: Engineers get actionable checklists and templates for presenting test data and qualification records. Background & Key Identifiers What “5225392-2” and N-Type mean Point: The part string indicates a specific part family and variant; the “5225392-2 N-Type connector” denotes a 50 Ω threaded RF plug variant. Evidence: Naming convention separates family number and suffix for gender/termination. Explanation: For qualification, record full part number, gender (plug), mating style (threaded), and declared impedance to match system requirements. Typical applications and use cases Point: N-Type connectors are used where mechanical robustness and reliable RF performance are required. Evidence: Common deployments include lab test cables, coaxial assemblies, base-station cabling, and RF fixtures. Explanation: The threaded coupling and larger contact geometry improve durability and handling versus smaller RF interfaces, making them a common choice up to ~11 GHz in practical systems. Electrical Specifications: What to Verify Core RF metrics to record and expected ranges Point: Extract and report core RF metrics: impedance (50 Ω), rated frequency, VSWR/return loss, insertion loss, contact resistance, and insulation resistance. Evidence: Typical acceptable insertion loss is ≤0.3 dB across the band and VSWR 16 dB) for a qualified assembly in lab checks. Explanation: Report each metric with units, test conditions (frequency span, temperature), and sample statistics (N, mean, stdev) to support acceptance decisions; always include raw test data files. Voltage, insulation, and temperature limits Point: Verify insulation resistance, dielectric breakdown ratings, and operating temperature range against the datasheet. Evidence: Datasheet values commonly include high insulation resistance (GΩ-scale) and wide operating temperatures; record the exact numbers from the supplier sheet. Explanation: These limits determine qualification boundaries for high-voltage checks, temperature cycling, and field use in extreme ambient conditions—note any derating required for continuous operation. Mechanical & Environmental Specs Mechanical features and termination guidance Document coupling thread type, mating torque, durability cycles, and recommended termination method. Typical items to record include thread spec, torque values, and specified mating cycles. Environmental resilience and reliability notes Confirm sealing, corrosion resistance, and humidity performance. Datasheet test tables often list temperature cycle ranges and humidity soak results for service environment alignment. Test Setup, Methods & Example Test Data Recommended test setup and measurement procedure ✔ Use a calibrated VNA with SOLT or TRL calibration. ✔ Apply specified mating torque for consistent contact. ✔ Sweep frequency to maximum rated band (11 GHz). Standard Acceptance Report Table Metric Typical Acceptance Performance Visual Insertion Loss ≤0.3 dB (DC–11 GHz) VSWR Contact Resistance Field Case Study & Practical Checklist Field Case Study Summary Point: A bench test of new versus reused connectors revealed degraded insertion loss and sporadic VSWR spikes on reused parts. Evidence: Lab runs showed mean insertion loss increase of ~0.2 dB and elevated variance for reused connectors. Explanation: Root cause analysis attributed issues to wear, contamination, and improper reassembly; corrective actions included replacing worn parts and instituting inspection criteria. Installation & Troubleshooting Checklist ● Verify torque values during mating. ● Conduct visual crimp inspection for die marks. ● Periodic VNA spot checks on production samples. ● Use symptom→cause→remedy flow for debugging. Summary Key Takeaways 1 Extract datasheet essentials: rated frequency, insulation resistance, and torque specs to ensure selection matches system limits. 2 Must-run tests: calibrated VNA sweeps, DC contact resistance, and insulation resistance with raw data files for traceability. 3 Enforce torque, crimp inspection, and storage controls to prevent field failures and maintain high production standards. Frequently Asked Questions What are key electrical limits to verify on an N-Type connector? + Point: Verify impedance, VSWR/return loss, insertion loss, contact resistance, and insulation resistance. Evidence: Record values across the frequency band under controlled conditions. Explanation: These parameters determine RF system performance and must be reported with statistical metrics for acceptance. How should test data be archived for production lots of N-Type connector assemblies? + Point: Archive raw VNA sweeps, CSVs, calibration records, and sample photographs of terminations. Evidence: Include test logs with sample IDs, torque values, and pass/fail flags. Explanation: Retaining raw data enables troubleshooting and provides evidence for lot release decisions. What immediate checks resolve a sudden VSWR spike in the field for an N-Type connector? + Point: Use a short checklist: verify torque, inspect for debris, and perform return loss checks. Evidence: VSWR spikes commonly result from poor mating or contamination. Explanation: Cleaning threads and re-torquing quickly isolates the fault and restores link performance.